Understanding how to manage one’s own finances is as important as ever in today’s society. Students should be given the opportunity to start learning the basic skills needed as an adult to prevent themselves from entering into financial crisis, as many often do. As students enter college, and gain much more responsibility for their own finances, they often lack the knowledge to prevent themselves from going in to debt, earning a poor credit score and more. Economics teacher Tristan Forgach explains the necessity for students being taught these basic lessons and how it could affect them for the rest of their lives.

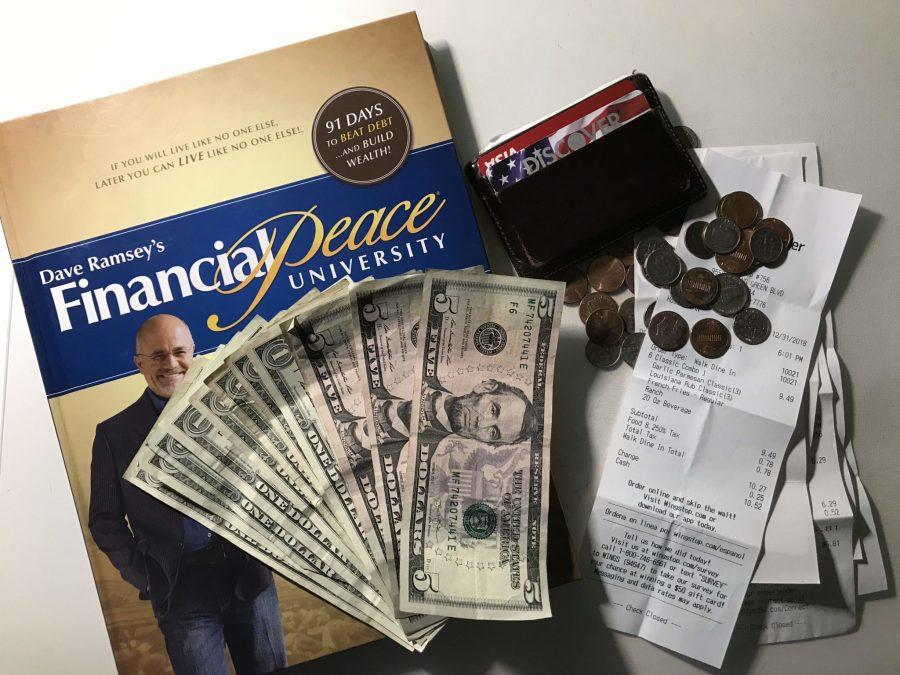

“I think the most obvious benefit would be more financially responsible adults. Credit card debt in this country is over $1 trillion. By teaching students financial literacy, we can hope to begin to reverse this trend. Credit cards can be a great tool, if you pay off the balance at the end of the month,” said Forgach.

Forgach cites the possible consequences of teaching students financial responsibility and the benefits it could pose for the rest of the country. With better educated students, society would greatly benefit from more responsible adults. However, Forgach explains that he believes a great deal of blame for the United States problems concerning debt comes from the federal government, and he details how it will most likely take several administrations of change to account for the issues the United States currently faces concerning credit card debt and more.

“Students that are not financially literate are more likely to go into debt, not pay bills on time, not file taxes, spend money in ways that are unwise, not make smart investments and have poor credit scores. All of these things can affect your ability to retire, buy a car or house, get a loan, and the interest rates they pay for loans of any type,” said Forgach.

Students who lack an awareness of the inner-workings of finances are put at a great disadvantage that could cause them serious issues for years to come. By not learning this information early on, students could be potentially making their lives exponentially harder by some of the future repercussions of poor spending habits and poor credit that Forgach outlines.

“One thing I recommend to my seniors is to get a credit card in their own name once they are 18. Current law stipulates that unless they can prove they have an income that will allow them to pay their bills, they must have a parent co-sign. Either way, making a few small charges every month and paying off the balance in full is one of the first steps to building good credit,” said Forgach.